2025 Year-End Planning Guide

Important Deadlines, Reminders, and Key Dates

The Fall is the Perfect Time to Prepare for Year-End Financial Deadlines

Leaves are changing, days are getting shorter, and the holiday season and year-end are rapidly approaching. Some items need to be done by year-end as January is too late. It’s not too early to prepare now to take action on year-end deadlines and other important financial decisions.

NOTE: Timing is Everything. Our custodians begin working on a “best-efforts basis ONLY” during the last two weeks of the year.

While they will try to get everything done:

-

- They may not be able to accommodate all requests.

- We are one of thousands of firms and advisors who will be pushing to get things done by year end.

- Custodians may also have limited staff.

Preparing for any year-end requirements before that will help ensure they are completed in a timely manner. Here are some helpful reminders.

Required Minimum Distributions (RMDs) & Qualified Charitable Distributions (QCDs)

- Don’t Wait Until December for RMDs and QCDs

- RMDs must be removed from the IRA by December 31 or you may incur a penalty

They can be satisfied:

-

-

- By ACH OUT to a bank

- Journaled to a NON-retirement account or

- Sent as a QCD to your charity of choice 501(C)(3)

-

For those who do not itemize, QCDs can be a great way to give to your favorite charities with your pretax dollars, and have your donation count toward satisfying your RMD.

-

-

- Your 2025 QCD limit is $108k (and can help avoid tax-bracket creep)

- Checks must be made payable to the charity and are sent via regular mail from the Custodian (e.g. Schwab) directly to the charity, or you can opt to have the check mailed to your home so you can hand deliver the check to your charity.

- We would like to see the checks in the mail BEFORE the holiday mail rush.

- The checks must be received by your charity BEFORE year end – we need to be sure your check is received in a timely manner and counted for 2025. Keep in mind, again, that their staff may also take year-end vacations.

- Ask the charity for a receipt for tax purposes (this can be sent to you after year end).

- If you need more details, please reach out to your advisor.

- We defer to your CPA who knows your specific tax situation and what will be most beneficial for you

- Your 1099R will NOT designate QCD vs RMD – you will need to tell your CPA you made a QCD so that you will not pay taxes on the QCD dollar amount

-

401(k) Retirement Plan Contributions

Maximize Contributions Before December 31

-

-

-

All contributions must be deposited before December 31.

-

New 401(k) plans would need to be opened ideally by the beginning of December to avoid a best-efforts basis by the Custodian or any unforeseen “NIGO”s (not in good orders) that would require more paperwork to complete the opening process on time.

-

-

2025 Year-End Planning Guide: FAQs

Important Deadlines, Reminders, and Key Considerations

Q. Why should I begin year-end planning now?

By acting early, you give yourself and your advisory team time to coordinate distributions, gifting, contributions, and investment changes, ensuring that all actions are processed and confirmed well before year-end cutoffs.

Q. What happens if I miss my Required Minimum Distribution (RMD)?

A. If you’re subject to RMDs, missing the December 31 deadline can result in an IRS penalty of 25% of the amount not withdrawn.

We encourage all clients to complete RMDs no later than early December to avoid last-minute issues with custodian-processing times or holiday closures.

Q. Can I use my RMD to make charitable gifts?

A. Absolutely. You can satisfy your RMD through a Qualified Charitable Distribution (QCD), directing up to $108,000 (2025 limit) from your IRA to a qualified 501(c)(3) charity.

Benefits include:

- Reducing your taxable income by donating pre-tax dollars

- Fulfilling your RMD requirement while supporting causes meaningful to you

- Avoiding “tax bracket creep” that can accompany larger distributions

To qualify, the funds must be sent directly to the charity and received before December 31.

Q. How should I process a Qualified Charitable Distribution (QCD)?

A. You can initiate a QCD through your custodian (e.g., Schwab). The check must be made payable to the charity, not to you personally.

You can choose to:

- Have the check mailed directly to the charity, or

- Receive it at your home and hand-deliver it

We recommend having all QCD requests submitted before the holiday mail rush to ensure timely delivery. Always request a receipt from the charity for your records and inform your CPA at tax time. Your Form 1099-R will not distinguish between QCDs and regular RMDs.

Q. How do 401(k) and retirement plan contribution deadlines work?

A. To be eligible for 2025 tax-year contributions:

- Employee contributions must be deposited by December 31, 2025.

- New 401(k) plans should ideally be opened by early December, allowing time for approval and to avoid “NIGO” (not-in-good-order) delays that can prevent the plan from being active by year-end.

For business owners, this is also an ideal time to evaluate profit-sharing contributions, cash balance plans, and defined benefit plan opportunities that can enhance tax efficiency.

Q. What does it mean when custodians operate on a “best-efforts” basis?

A. During the final two weeks of December, custodians such as Schwab, Fidelity, and others experience extremely high transaction volumes. At that stage, they process requests as capacity allows, without guaranteed completion by year-end.

Submitting instructions early, ideally by early December, ensures your requests receive full priority and can be confirmed well before the cutoff period.

Q. When should I send charitable distribution checks?

A. We recommend that charitable giving requests be initiated by mid-November.

Mail and processing slow considerably during the holidays, and most charities also operate with reduced staffing at year-end.

Checks must be received by the charity before December 31 to count toward the 2025 tax year.

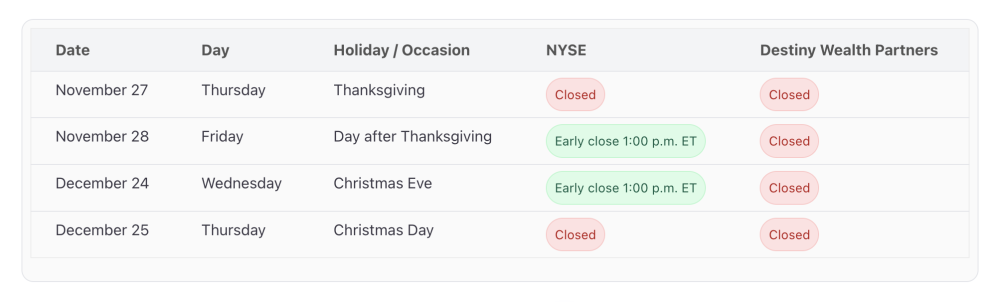

Q. How do market holidays affect trading and transactions?

A. See the deadlines and closing dates on this page. We recommend executing trades or transfers no later than December 20 to ensure settlement before year-end.

Q. How will these actions affect my taxes?

A. While we can advise on strategy, your CPA or tax professional should confirm how specific actions, such as RMDs, QCDs, or retirement plan contributions, will impact your individual tax situation.

We are happy to collaborate with your tax team to ensure alignment and documentation.

Q. Who should I contact for assistance?

A. Your Destiny Wealth Partners advisor is your first point of contact.

Your advisor can:

- Coordinate with custodians to process year-end requests

- Facilitate charitable giving or gifting strategies

- Ensure transactions are completed and documented accurately

- Collaborate with your CPA or estate attorney for integrated year-end planning

We encourage scheduling a year-end planning call as soon as possible to ensure timely execution.

Trading Dates – NYSE & Destiny Wealth Partners Year-End Schedule

Connect with Your Advisor

Reach out directly to your advisor today to discuss year-end planning or call our office at 352.343.2700